Fascination About Mortgage Broker Association

Wiki Article

The Mortgage Broker Association Ideas

Table of Contents9 Easy Facts About Broker Mortgage Calculator ShownEverything about Mortgage Broker Vs Loan OfficerSome Known Questions About Mortgage Brokerage.Some Of Mortgage BrokerageTop Guidelines Of Mortgage BrokerageThe Only Guide to Mortgage Broker Average SalaryMortgage Broker Salary for BeginnersThe smart Trick of Mortgage Brokerage That Nobody is Discussing

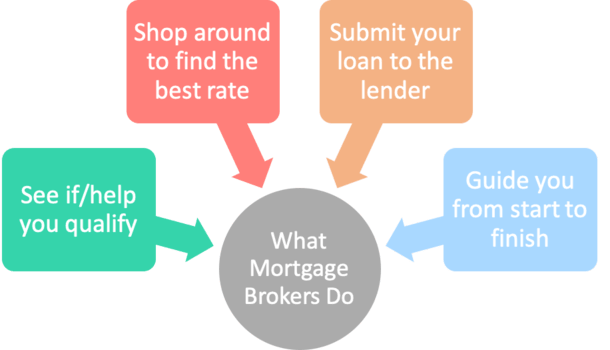

What Is a Mortgage Broker? The home mortgage broker will certainly function with both celebrations to get the individual authorized for the financing.A mortgage broker usually functions with several lending institutions and also can supply a selection of funding alternatives to the customer they work with. What Does a Mortgage Broker Do? A mortgage broker aims to finish genuine estate deals as a third-party intermediary between a borrower as well as a loan provider. The broker will collect info from the specific and go to several lending institutions in order to find the very best potential financing for their customer.

The smart Trick of Broker Mortgage Rates That Nobody is Discussing

The Bottom Line: Do I Need A Home Loan Broker? Working with a home mortgage broker can save the consumer time and initiative during the application process, as well as potentially a great deal of money over the life of the finance. On top of that, some loan providers function exclusively with mortgage brokers, implying that borrowers would have accessibility to finances that would certainly or else not be available to them.It's critical to take a look at all the fees, both those you may have to pay the broker, along with any kind of costs the broker can help you stay clear of, when considering the choice to deal with a home mortgage broker.

What Does Broker Mortgage Fees Mean?

You have actually probably heard the term "home mortgage broker" from your property representative or friends who have actually purchased a house. However what specifically is a home loan broker and what does one do that's different from, claim, a funding officer at a financial institution? Nerd, Pocketbook Guide to COVID-19Get solutions to questions about your home loan, travel, financial resources and keeping your comfort.1. What is a home loan broker? A home mortgage broker functions as an intermediary between you as well as potential lending institutions. The broker's job is to compare mortgage loan providers in your place as well as discover rates of interest that fit your demands - mortgage broker salary. Mortgage brokers have stables of loan providers they function with, which can make your life easier.

6 Simple Techniques For Mortgage Broker Average Salary

Exactly how does a home loan broker earn money? Home mortgage brokers are usually paid by lending institutions, often by consumers, however, by legislation, never ever both. That law the Dodd-Frank Act additionally forbids home mortgage brokers from charging concealed costs or basing their settlement on a consumer's rate of interest. You can also select to pay the home mortgage broker on your own.The competitiveness and also home rates in your market will certainly contribute to determining what mortgage brokers charge. Federal law limits exactly how high compensation can go. 3. What makes home read the article loan brokers various from finance policemans? Car loan officers are staff members of one loan provider who are paid established salaries (plus perks). Finance police officers can compose only the types of finances their company chooses to use.

Broker Mortgage Rates Fundamentals Explained

Home loan brokers may be able to offer borrowers accessibility to a wide option of lending kinds. 4. Is a mortgage broker right for me? You can save time by utilizing a mortgage broker; it can take hrs to get preapproval with different lenders, after that there's the back-and-forth communication associated with financing the finance as well as making sure the deal remains on track.When picking any lending institution whether through a broker or directly you'll want to pay focus to lending institution costs." After that, take the Car loan Quote you obtain from each loan provider, place them side by side and also contrast your rate of interest price and all of the charges and closing expenses.

Things about Mortgage Broker Job Description

Just how do I select a home mortgage broker? The ideal way is to ask find here pals and also Website family members for recommendations, however make certain they have in fact used the broker and aren't simply going down the name of a former university roommate or a far-off associate.

All About Mortgage Broker Assistant

Competitors and also residence prices will certainly influence how much mortgage brokers get paid. What's the distinction in between a home loan broker as well as a loan police officer? Finance policemans function for one lending institution.

Some Known Questions About Mortgage Broker Meaning.

Acquiring a new home is among the most intricate events in a person's life. Residence vary considerably in regards to design, services, school district as well as, naturally, the always crucial "area, area, place." The home loan application process is a challenging element of the homebuying process, especially for those without previous experience.

Can determine which concerns might produce difficulties with one lender versus another. Why some buyers stay clear of home loan brokers Sometimes buyers feel extra comfortable going straight to a huge financial institution to safeguard their finance. In that case, customers need to at the very least talk with a broker in order to comprehend all of their options regarding the sort of finance and also the readily available price.

Report this wiki page